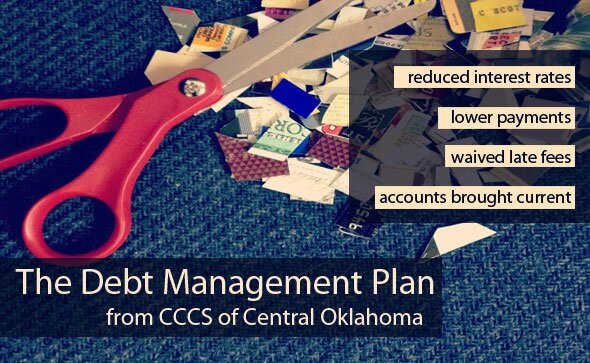

- Live Debt-Free!

- Let CCCSOK.org help you reduce interest rates, lower payments, bring your accounts current and waive late and over the limit fees

- Get more information here

- Trusted by Oklahomans since 1967 to provide confidential budget and credit counseling.

- Your only LOCAL brick and mortar non-profit credit counseling agency dedicated to serving central and western Oklahoma.

- Board Information

![]()

- Understanding Payday Loans

- The Truth about Debt Settlement

- Identity Theft Protection

- Avoiding Housing Scams

- Start the process online

- CCCS offers both Pre-Filing Credit Counseling and Pre-Discharge Debtor Education Certificates in accordance with Federal Bankruptcy Regulations.

- Find more information here

![]()

Get advice, inspiration and a slice of CCCS life by following blogs written by the experts at CCCSOK.org.

- the Education Blog

- CCCS Staff Contributors Blog

- Find us on Facebook, Twitter, Pinterest and LinkedIn

- Help CCCS of Central Oklahoma continue to provide free counseling and low-cost services to help supportOklahoma’s families and economy.

- Buy an hour of counseling for someone in need!

More info

- Fiscally Fit Bootcamp – our most popular choice!

- Fiscally Fit Workshop

- Better Fortunes (Online!)

- Credit When Credit is Due (Self-Study!)

-

Custom Education

or Host a training event for your office or organization!

Brochure | Contact Us | FAQs | Partners | Locations | Tools | Privacy Policy | MyMoneyCheckup